Establishing An LLC: Difference between revisions

No edit summary |

No edit summary |

||

| (6 intermediate revisions by 3 users not shown) | |||

| Line 10: | Line 10: | ||

I incorporated in Delaware for all of my LLCs but for the ones where I was running operations in California, I wish I had just incorporated there. | I incorporated in Delaware for all of my LLCs but for the ones where I was running operations in California, I wish I had just incorporated there. | ||

=== Scams === | |||

[[File:Scan of a Post-LLC Establishment Compliance Scam.webp|thumb|You don't have to pay these people anything]] | |||

Once your company has been entered into the public record, people will start spending you scam letters in the mail that appear official enough that you might be tempted to pay them the small amount to go away. They're just fishing for such people, though. None of these companies, of which there are many, are in charge of these forms. You often do have to put up the forms, but these guys aren't anyone special. They'll just print you the same thing you can get online and send it to you. | |||

=== Foreign Qualification === | === Foreign Qualification === | ||

| Line 20: | Line 25: | ||

Ultimately, you only need the short form Certificate of Good Standing in order to proceed with Foreign Qualification. | Ultimately, you only need the short form Certificate of Good Standing in order to proceed with Foreign Qualification. | ||

== Banking == | |||

[[File:Mercury Bank - Dashboard Screenshot.png|thumb|The Mercury Dashboard view]] | |||

It's better to have a bank account for your LLC as soon as possible. This minimizes the chance of commingling personal and LLC funds, something you don't want to do because you'll lose the protection of the LLC according to people on the Internet. I have not verified this but it is trivial to actually make a bank account provided you're involved in actual business. | |||

I used [https://mercury.com/r/technology-brother Mercury] for all my banking (that's a referral link). They have a straightforward process to apply and if they think you're a legitimate business they'll approve your account pretty quickly. | |||

== Accounting == | == Accounting == | ||

| Line 61: | Line 73: | ||

If you're in California you'll also have to register with the state for an [https://eddservices.edd.ca.gov/ EDD number] so that you can correctly handle state taxes and so on. This is a straightforward process. | If you're in California you'll also have to register with the state for an [https://eddservices.edd.ca.gov/ EDD number] so that you can correctly handle state taxes and so on. This is a straightforward process. | ||

A little while after you finish the online portion, they'll call you from a "No Caller ID" to ask you for your EIN and the street address. I know, it seems like a scam, but that's how they do it and then it'll be approved and you'll get all the information required to run payroll. The guy on the other side also pointed me to [https://edd.ca.gov/siteassets/files/pdf_pub_ctr/de160.pdf this user guide] and was an all around mensch. But it ''will'' seem like a scam. | A little while after you finish the online portion, they'll call you from a "No Caller ID" to ask you for your EIN and the street address. I know, it seems like a scam, but that's how they do it and then it'll be approved and you'll get all the information required to run payroll which is: | ||

* Your EDD Number (absolutely required) | |||

* Your Unemployment Insurance Rate (SUI) - this is 3.4% to start with so you could theoretically do without being told | |||

* Whether you have Employment Training Tax (0.1%) - you usually do | |||

The guy on the other side also pointed me to [https://edd.ca.gov/siteassets/files/pdf_pub_ctr/de160.pdf this user guide] and was an all around mensch. But it ''will'' seem like a scam. | |||

=== Depositing Taxes === | |||

One of the things you'll have to do if you have an employee is pay taxes on time. I use [https://payroll.zoho.com/ Zoho Payroll] to run payroll. It was the most affordable thing and since I already use Zoho Mail it was quite simple to do. | |||

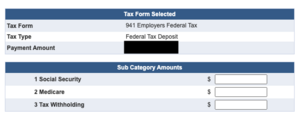

[[File:Form 941 on EFTPS Subcategories.png|thumb|alt=Form 941 showing subcategories unfilled|Form 941 showing subcategories unfilled. It's okay to do that. If you have an employee who is exempt from Social Security and Medicare filling this in will be tough since 0 is not an accepted value.]] | |||

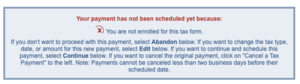

[[File:EFTPS - Form 941 First Time Submission Warning.png|thumb|alt=A screenshot of EFTPS showing the warning it displays on first time submission: Your payment has not been scheduled yet because: (X) You are not enrolled for this tax form. If you don't want to proceed with this payment, select Abandon below. If you want to change the tax type, date, or amount for this new payment, select Edit below. If you want to continue and schedule this payment, select Continue below. If you want to cancel the original payment, click on "Cancel a Tax Payment to the left. Note: Payments cannot be canceled less than two business days before their scheduled date.|This warning shows up the first time you pay this tax. Despite what it's saying it's intended to say that you haven't previously paid this before.]] | |||

The other thing you should do is sign up for [https://www.eftps.gov/eftps/ EFTPS] to pay taxes online to the Federal Government. This is quite straightforward, but you should do it ahead of time since they'll take a week to send you a mail with your PIN in it and your enrollment number. You'll need your EIN to get this done and the address you receive mail at. | |||

Once you have your PIN, you can complete registration and pay your taxes. I haven't missed my date so I can't tell you what happens if you do but your payroll software will tell you everything. Just set a reminder to look at it every month and schedule what it tells you is due within the month. | |||

EFTPS is not the most user-friendly software. It will display a warning the first time you pay for a form to make sure you're not accidentally depositing money to the government. This is probably because it's hard to get it back. You should hit Continue if you want it to go through. | |||

=== Filing Taxes and Providing W-2s === | |||

Getting a W-2 per employee is something you can fill out yourself by hand. You just: | |||

# Request the Copy A sheet from the IRS (these red forms can't be printed) | |||

# Get the appropriate year Form W-2 for everything else, then fill out all the copies | |||

# Mail the copies to the appropriate recipients (IRS, State, Employee) | |||

One other alternative is to file via [https://www.ssa.gov/bso Social Security Administration's Business Services Online service]. Fair warning: this takes 2 weeks to activate. And then once you've sent in the W-2 for each employee and the W-3 that summarizes the total tax and salary paid and all that, you have to send the other copies of the W-2 to everyone else. | |||

A third option is to use one of the authorized online filers like [https://www.taxbandits.com/ TaxBandits.com] or [https://www.expressirsforms.com/ ExpressIRSForms] (which now seem to be the same company since the former uses the latter's S3 bucket). This is ultimately what I chose to do since TaxBandits.com ultimately does mail the paper W-2 and also files the W-2 and W-3 with the IRS and so on. | |||

You will need to be able to verify your identity for all this, so have your drivers license handy. | |||

{{#seo:|description=Comprehensive guide on setting up an LLC, covering incorporation, foreign qualification, and banking - written in informative, engaging third-person style}} | |||

[[Category:Tips]] | [[Category:Tips]] | ||

Latest revision as of 08:16, 20 November 2025

Here's my experience setting up LLCs and the kind of stuff I needed to do.

Incorporating

[edit]This phase is best done using one of the established companies in the space. My friends and I have used Stripe Atlas, Firstbase, and LegalZoom. My best experiences have been with LegalZoom.

This part is pretty mechanical and it's best to just use one of these companies. They'll default to Delaware.

To be honest, it doesn't sound like incorporating in Delaware has any advantage if you're just trying to run a side business in California. Or I haven't found any. You just end up paying the Delaware Agent Fees and the Delaware annual tax ($300).

I incorporated in Delaware for all of my LLCs but for the ones where I was running operations in California, I wish I had just incorporated there.

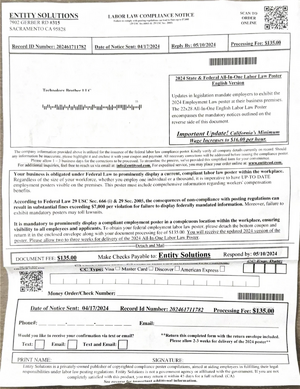

Scams

[edit]

Once your company has been entered into the public record, people will start spending you scam letters in the mail that appear official enough that you might be tempted to pay them the small amount to go away. They're just fishing for such people, though. None of these companies, of which there are many, are in charge of these forms. You often do have to put up the forms, but these guys aren't anyone special. They'll just print you the same thing you can get online and send it to you.

Foreign Qualification

[edit]One of the LLCs had to operate in California, and to do that and hire people you need to register to operate there. This is why there's no value in registering in Delaware if you want to do business in California: you'll end up paying exactly the same fees every year!

Anyway, this is where you do it. Pick 'Registration - Out of State LLC'.

If you had a Delaware LLC, you'll have to first get a Certificate of Good Standing. You can get this from the Delaware Division of Corporations but I chose to get it from a proxy online lawyer. The reason for this is that the official government website will frequently go offline after work hours or on the weekend. If you file it with the lawyer to do the work for you it's a $100 premium but simplifies the whole thing.

Ultimately, you only need the short form Certificate of Good Standing in order to proceed with Foreign Qualification.

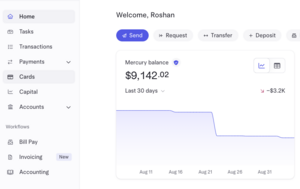

Banking

[edit]

It's better to have a bank account for your LLC as soon as possible. This minimizes the chance of commingling personal and LLC funds, something you don't want to do because you'll lose the protection of the LLC according to people on the Internet. I have not verified this but it is trivial to actually make a bank account provided you're involved in actual business.

I used Mercury for all my banking (that's a referral link). They have a straightforward process to apply and if they think you're a legitimate business they'll approve your account pretty quickly.

Accounting

[edit]I used Wave because it has a free tier but Quickbooks etc. are a good option. One thing I haven't yet tried but might work really well is the Zoho books app which I encountered only because I use the Zoho Mail app for cheap mail.

Domain

[edit]I bought my domain on Google Domains but they're dead so I recommend using NameCheap. They're simple enough to use and you only want to register with them.

Use Cloudflare for all domain stuff. They'll allow you to redirect email etc. if you'd like to take that approach, though I chose to get a webmail provider.

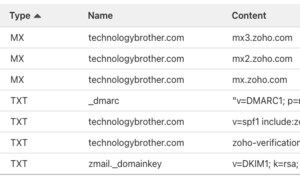

Webmail

[edit]

It's possible to forward your email to your personal email, but I wanted everything nice and neat, so I used a webmail provider. The cheapest I found was Zoho Mail at $12/year. They've got a bunch of other things quite cheap which makes me think I should use them more.

If you want people to receive your mail you'll need to set up the following:

- SPF

- DKIM

- DMARC

Hiring

[edit]You'll have to verify someone's right to work where you are, but that's really about it. That's the Form I-9.

In order to hire someone on OPT, you don't have to do very much. The key thing you'll have to do is verify their EAD in person (there's a way out of this but I chose to keep it simple so I don't inadvertently fuck it up) and then the two of you make sure Form I-9 is filled out and kept somewhere safe so that you can show the DHS and friends when they ask.

The STEM extension is its own thing, and to be honest, you should just get a lawyer. Everyone uses Fragomen because they're cheap, but they routinely fuck things up so I use someone I know I can trust: Serotte Law. These guys have helped me with employment-related immigration both as an employee and as an employer. They're all very smart and have things buttoned down.

E-Verify

[edit]You'll need to enroll in E-Verify if you have some kinds of employees. In my case, I had someone I'd have to take on their STEM-extension for OPT. The process is quite straightforward, but after that you have to make sure to enter all your employee information in there.

The only thing of note is that if you get into E-Verify and if you have someone starting, you're going to have to put them in there within 3 days of their start date.

California EDD

[edit]If you're in California you'll also have to register with the state for an EDD number so that you can correctly handle state taxes and so on. This is a straightforward process.

A little while after you finish the online portion, they'll call you from a "No Caller ID" to ask you for your EIN and the street address. I know, it seems like a scam, but that's how they do it and then it'll be approved and you'll get all the information required to run payroll which is:

- Your EDD Number (absolutely required)

- Your Unemployment Insurance Rate (SUI) - this is 3.4% to start with so you could theoretically do without being told

- Whether you have Employment Training Tax (0.1%) - you usually do

The guy on the other side also pointed me to this user guide and was an all around mensch. But it will seem like a scam.

Depositing Taxes

[edit]One of the things you'll have to do if you have an employee is pay taxes on time. I use Zoho Payroll to run payroll. It was the most affordable thing and since I already use Zoho Mail it was quite simple to do.

The other thing you should do is sign up for EFTPS to pay taxes online to the Federal Government. This is quite straightforward, but you should do it ahead of time since they'll take a week to send you a mail with your PIN in it and your enrollment number. You'll need your EIN to get this done and the address you receive mail at.

Once you have your PIN, you can complete registration and pay your taxes. I haven't missed my date so I can't tell you what happens if you do but your payroll software will tell you everything. Just set a reminder to look at it every month and schedule what it tells you is due within the month.

EFTPS is not the most user-friendly software. It will display a warning the first time you pay for a form to make sure you're not accidentally depositing money to the government. This is probably because it's hard to get it back. You should hit Continue if you want it to go through.

Filing Taxes and Providing W-2s

[edit]Getting a W-2 per employee is something you can fill out yourself by hand. You just:

- Request the Copy A sheet from the IRS (these red forms can't be printed)

- Get the appropriate year Form W-2 for everything else, then fill out all the copies

- Mail the copies to the appropriate recipients (IRS, State, Employee)

One other alternative is to file via Social Security Administration's Business Services Online service. Fair warning: this takes 2 weeks to activate. And then once you've sent in the W-2 for each employee and the W-3 that summarizes the total tax and salary paid and all that, you have to send the other copies of the W-2 to everyone else.

A third option is to use one of the authorized online filers like TaxBandits.com or ExpressIRSForms (which now seem to be the same company since the former uses the latter's S3 bucket). This is ultimately what I chose to do since TaxBandits.com ultimately does mail the paper W-2 and also files the W-2 and W-3 with the IRS and so on.

You will need to be able to verify your identity for all this, so have your drivers license handy.